Author: summerfield_admin

2019 – 2020 新财年移民配额变化 2019-2020 Migration Program Planning Levels

【2019 – 2020 新财年移民配额变化】

2019-2020 Migration Program Planning Levels

| 签证类型 Stream and Category | 2018-19 | 2019-20 | 变化 | |

| 技术类别

Skill Stream |

雇主担保 Employer Sponsored | 48,250 | 30,000 | -38% |

| 独立技术 Skilled Independent | 43,990 | 18,652 | -58% | |

| 技术类雇主担保 Skilled Employer Sponsored | 23,000 | 新增 | ||

| 工作签证 Skilled Work Regional | 9,000 | |||

| 州担保 State / Territory Nominated | 28,850 | 14,000 | ||

| 商业创新及投资类别 Business Innovation & Investment Program | 7,260 | 24,968 | -13% | |

| 全球商业天才类别 Global Talent | 6,862 | -5% | ||

| 境外杰出人才类别 Distinguished Talent | 200 | 5,000 | 0% | |

| 技术类合计 Skill Total | 128,550 | 200 | -15% | |

| 亲属移民类别

Family Stream |

配偶 Partner | 47,825 | 108,682 | -17% |

| 父母 Parent | 8,675 | 39,799 | -15% | |

| 其他亲属类别 Other Family | 900 | 7,371 | -38% | |

| 亲属移民共计 Family Total | 57,400 | 562 | -17% | |

| 特殊类别 Special Eligibility | 565 | 47,732 | -58% | |

| 儿童签证 Child (estimate; not subject to a ceiling) | 3,485 | 236 | -4% | |

| 合计 Total | 190,000 | 3,350 | -16% |

偏远地区雇主担保 Skilled Employer Sponsored

偏远地区工作 Skilled Work Regional

技术移民类 Skill Stream(108682)

- 联邦雇主担保 Employer Sponsored

- 独立技术移民 Skilled Independent

- 偏远地区雇主担保 Skilled Employer Sponsored

- 偏远地区工作 Skilled Work Regional

- 偏远地区州政府担保 State/ Territory Nominated

- 商业创新及投资移民 Business Innovation & Investment Program

- 全球商业天才 Global Talent

- 杰出技术人才 Distinguished Talent

亲属移民 Family Stream

- 配偶移民 Partner

- 父母移民 Parent

- 其他亲属类 Other Family

- 特殊签证类 Special Eligibility

- 子女 Child

澳大利亚技术移民 (独立技术移民 SC189,偏远地区州政府担保移民)

澳洲技术移民签证是依靠申请人的学历、工作经验/专业技能、语言成绩等自身综合能力提出申请,通过打分测试达到最低分数标准之后提交意愿书 (EOI),并获得移民局邀请后递交申请的移民签证类别,其中SC189, SC190赋予签证持有者在澳永居。SC489是一个4年的临时签证,签证持有人在满足要求后可以申请SC887永居签证。

技术移民签证类别,申请人需要满足几项必要条件才能够提交相应的意愿书,这包括:

- 申请人年龄在提交申请时年龄在45岁以下

- 申请人至少有雅思四个6分或其他被认证的英语考试成绩

- 申请人必须提名澳洲独立技术移民职业列表上的相关职业并通过职业评估。(通过相关的职业提名的职业评估通常对申请人有英语成绩,学历,工作经验的相关要求)212 MLTSSL (189,190,489 relative), 215 STSOL (190, 189), 77 ROL (189,190,489)

- 申请人至少可以获得65分的技术移民分数。其中偏远地区州政府担保SC190会获得5分州担保分, SC489 会获得10分州担保加分。

- 澳洲技术移民打分体系是建立在技术移民的基本要求之上,申请人获得移民粉丝取决于申请人的年龄,学历,工作经验等因素。澳洲技术移民加分方式有多种途径可选,雅思4个7分,报读 Professional Year职业年和NATTI翻译,申请州政府担保,工作经验加分,配偶职业技能加分等。

188A,B 签证申请基本条件

- 需要获得EOI邀请 (be invited to apply)

- 有州政府担保

- 年龄小于55周岁 (除非得到州政府豁免)

- 评分达到65分

- 成功的商业或投资历史

188A 商业创新类别的额外要求:

- 申请人(或与配偶合计)拥有的家庭总资产不少于80万澳币,这些资产都是通过合法途径获得并且能够在发签的2年之内转达到澳大利亚;

- 过去4个财政年中至少有2年,一夜年营业额不低于50万澳币;

- 营业额年增长率低于40万的公司,占用至少51%的股份;

- 营业额年增长率高于40万的公司,占有至少30%的股份;

- 如果是上市公司 (publicly-listed company),占有至少10%的股份

- 成功的经营背景;

- 申请人在获批188A签证后,登录澳洲并满足相关要求和可以提交888A永居签证申请。

188B投资类别的额外要求:

- 申请人(或与配偶合计),过去2个财政年中拥有的净资产不少于225万澳币;

- 3年以上良好的管理生意或投资经验;

- 近5个财政年中至少有1年,在企业中占有10%以上的股份或者管理150万澳币以上的投资;

- 申请人持续商业行为的承诺,申请人承诺在政府指定投资期满以后仍持续操作生意或进行投资管理;

- 申请人在获批188B签证后,登录澳洲并满足相关要求和可以提交888B永居签证申请。

澳洲188C投资移民(重大投资临时签证)

- 要求申请人至少投资500万澳币到澳洲,没有年龄限制,没有英语要求,无需打分。该签证还大幅减少了居住要求,申请人只需在持有188C临居签证的4年中,在澳大利亚住满160天;

- 申请人在获批188C签证后,登录澳洲并满足相关要求和可以提交888C永居签证申请。

Visa Information on: BUSINESS VISA AS IN AUSTRALIA

Visa Information on: BUSINESS VISA AS IN AUSTRALIA

Subclass 188 Visa – Business Innovation and Investment (Provisional)

This is a temporary visa valid for 4 years on grant. This visa allows 188 holders time to meet the criteria of, and apply for, a subclass 888 permanent residence visa.

The subclass 188 visa has five types of Eligibility Streams:

- The Business Innovation Stream (points-tested) – for people who want to own and manage a new or existing business in Australia.

- The Investor Stream (points-tested) – for people who want to make a designated investment in an Australia state or territory.

- Significant Investor Visa (SIV) Stream – for people who want to invest at least AUD 5 million into complying investments in Australia.

- Premium Investor (PIV) Stream – for people who want to invest at least AUD 15 million into complying investments in Australia (Note: This visa will be available at the invitation of the Australian Government only, with potential recipients to be nominated by Austrade).

- Entrepreneur Stream – for entrepreneurs with innovative ideas and financial backing from a third party.

(1) STREAM A: BUSINESS INNOVATION

| Criteria | (1) THE BUSINESS INNOVATION STREAM (188 PROVISIONAL) VISA |

| Objective | For people who want to own and manage a new or existing business in Australia. |

| Age | Less than 55 at the time of invitation |

| Points | Score (currently 65 points) on the Innovation Points Test – at the time of invitation. |

| State/Territory Nomination | Nominated by State or Territory Government. |

| Skill Select | Expression of Interest and Invitation by Dept. of Home Affairs to apply. |

| Net Assets (business & personal) | Applicant and/or spouse must have AUD$800,000 legally acquired and can be legally transferred to Australia within 2 years of the visa being granted. |

| Annual Turnover | For at least 2 out of 4 fiscal years before invitation, applicant’s main business/es overseas must have annual turnover of at least AUD$500,000. |

| Ownership Interest overseas | · At least 51%, if the business has turnover of less than AUD400,000 per year

· At least 30% if the business has turnover of AUD400,000 or more per year OR · At least 10% if the business is a publicity-listed company. |

| Successful Business Career | You must have an overall successful business career. |

| Management Role Overseas business | For at least 2 out of 4 fiscal years before invitation, applicant has spent at least 50% of time in management role in business that provides professional, technical or trade services. |

| Genuine Business Commitment | To establish or participate in active management of qualifying business in Australia and maintain substantial ownership interest. |

| Unacceptable Business Activity | Neither applicant nor spouse has history of unacceptable business activities. |

| English | Functional English (IELTS average score of: 4.5 minimum) or pay 2nd Visa Application Charge (VAC) for you & any accompanying family member aged 18 years and above. |

| Validity of visa | If you applied before 1 July 2015 – 4 years

If you applied after 1 July 2015 – 4 years and 3 months 4 years – possible extension if Extension criteria are met. |

(2) STREAM B: INVESTOR

| Criteria | (2) THE INVESTOR STREAM (188 PROVISIONAL) VISA |

| Objective | For people who want to make a designated investment in an Australian state or territory and want to maintain business and investment activity in Australia after the original investment has matured. |

| Age | Less than 55 at the time of invitation. |

| Points Test | Score (currently 65 points) on the Innovation Points Test – at the time of invitation. |

| State/Territory Nomination | Nominated by State of Territory Government. |

| Skill Select | Expression of Interest and Invitation by Dept. of Home Affairs to apply. |

| Management Skill | Overall successful record in relation to eligible investments* or qualifying business activity. |

| Direct Involvement | Have at least 3 years’ experience of direct involvement in managing one or more qualifying businesses/ or eligible investments. |

| Commitment | Have a genuine and realistic commitment to continuing your business and investment has matured. |

| Additional Requirements | For at least one of the 5 fiscal years before invitation, applicant must have directly managed one of the following activities:

· Eligible investments that total at least AUD$1.5 million; or · A qualifying business in which you owned at least 10% of the total value of the business. |

| Net Assets – business and personal | Applicant and/spouse have at least AUD$2.25 million for the 2 fiscal years immediately before the invitation.

These assets are lawfully acquired and available for transfer to Australia within 2 years after the grant of this visa. |

| Designated Investment | After entering Australia, you must maintain your designated investment for at least 4 years. |

| Source of Funds (for Designated Investment) | 1. Unencumbered; and

2. Accumulated from applicant’s and/or spouse: · Qualifying business/es; and or · Eligible investment activities/ |

| Unacceptable Business Activity | Neither applicant nor spouse has history of unacceptable business activities. |

| Business Obligations after visa grant | After entering Australia, you must maintain your designated investment in state bonds for at least 4 years. |

| English | Functional English (IELTS 4.5) or pay 2nd Visa Application Charge (VAC) for you & any accompanying family member aged 18 years and above. |

| Residence Requirement | Applicant must reside for at least 2 years in the nominating State. |

| Validity of visa | 4 years and 3 months

No extension is available. |

* ‘Eligible Investment’ that you had been involved with must be producing a return in the form of Income or Capital Gain, and not for personal use. (own residential cannot be counted)

Eligible investments include ownership:

- In a business, or

- Cash on deposit, or

- Stock or bond, or

- Real estate (not family home), or

- Gold or silver bullion, or

- Loan to a business if a person makes it for the purpose of producing an income or capital gain.

‘Designated Investment’ is investment in State or Territory government issued bonds.

(3) STREAM C: SIV (SIGNIFICANT INVESTOR STREAM)

| Criteria | (3) THE SIGNIFICANT INVESTOR STREAM (SIV 188 PROVISIONAL) VISA |

| Objective | For those who want to invest at least AUD$5 million into complying investments in Australia |

| Age | No age limit |

| Points | Not applicable |

| State/Territory Nomination | Nominated by State or Territory Government OR Austrade. |

| SkillSelect | Expression of Interest and Invitation by Dept. of Home Affairs to apply. |

| Investment | Must invest AUD$5 million in Complying Investments in Australia. |

| Commitment | Committed to hold Complying Investments for 4 years. |

| Source of Funds | · Applicant and/spouse have assets of at least AUD$5 million that:

· Have been legally acquired, · Are unencumbered, · And are available to be used to make the ‘Complying Investment’ in Australia. |

| Special forms | 1412 and 1423 must be signed |

| Unacceptable Business Activity | Neither applicant nor spouse has history of unacceptable business activities. |

| English | Functional English (IELTS 4.5) or pay 2nd Visa Application Charge (VAC) for you & any accompanying family member aged 18 years and above. |

| Residence Requirement | Applicant must live in Australia for at least 40 days per year (160 days calculated cumulatively over 4 years), OR your spouse must live for at least 180 days (720 days calculated cumulatively over 4 years). |

| Validity of visa | If you applied before 1 July 2015 – years

If you applied after 1 July 2015 – 4 years and 3 months Possible extension if Extension criteria are met |

A subclass 188 SIV holder may be able to apply for up to two extensions if the below criteria can be met.

Complying Investment for SIV:

You must make a complying significant investment of at least AUD 5 million over four years in the following proportions distributed across with:

- 10% – min. AUD 500,000 million in venture capital with growth private equity funds which invest in start-ups and small private companies.

- 30% – min. AUD 1.5 million in approved managed funds investing in emerging companies listed on the Australian Stock Exchange.

- 60% – min. a ‘balancing investment’ of at least AUD 3 million in managed funds that may be invested in a range of assets, including ASX-listed companies, Australian corporate bonds or notes, annuities and commercial real estate.

Advantages of the SIV 188 visa:

- No upper age limit,

- No English Language requirement,

- No Points Tests

- Provides for at least 2 Extensions – of 2 years each (if extension requirements are met)

- Lower residence requirement (40 days per year for main applicant or 180 days for spouse) to apply for the 888 Permanent visa.

(4) STREAM D: PREMIUM INVESTORS STREAM (PIV)

| Criteria | (4) THE PREMIUM INVESTOR STREAM (PIV 188 PROVISIONAL) VISA |

| Objective | For people who want to invest at least AUD 15 million into complying investments in Australia |

| Age | No age limit |

| Points | Not applicable |

| State/Territory Nomination | Nominated by Austrade only. |

| Investment | Must invest AUD$15 million in Complying Investments in Australia. |

| Commitment | Committed to hold Complying Investments for 12 months. |

| Source of Funds | · Applicant and/spouse have assets of at least AUD$15 million that:

· Have been legally acquired, · Are unencumbered, · And are available to be used to make the ‘Complying Investment’ in Australia. |

| Special forms | 1412 and 1423 must be signed |

| Unacceptable Business Activity | Neither applicant nor spouse has history of unacceptable business activities. |

| English | Functional English (IELTS 4.5) or pay 2nd Visa Application Charge (VAC) for you & any accompanying family member aged 18 years and above. |

| Validity of visa | 4 years and 3 months, no extension available |

Advantages of PIV 188 visa:

- No residence requirement

- Fast-track 12 months pathway to permanent residency

(5) STREAM E: ENTREPRENEUR

| Criteria | (5) THE ENTREPRENEUR STREAM (188 PROVISIONAL) VISA |

| Objective | For entrepreneur with innovative ideas and financial backing from a third party. |

| Age | Less than 55 at the time of invitation |

| Points | Not applicable. |

| State/Territory Nomination | Nominated by State or Territory Government. |

| SkillSelect | Expression of Interest and Invitation by Dept. of Home Affairs to apply. |

| Commitment | Be undertaking or proposing to undertake a ‘complying entrepreneur activity’ (see below) in Australia and have a genuine intention to continue this activity. |

| Complying entrepreneur activity | A complying entrepreneur activity is an activity that relates to an innovative idea that will lead that will lead to the commercialization of a product or service in Australia, or the development of an enterprise or business in Australia.

This activity must NOT relate to any of the following excluded categories: · Residential real estate · Labour hire · Purchase of an existing enterprise or a franchise in Australia. All of the following requirements must be met: · You have one or more legally enforceable agreements to receive funding with a total of at least AUD 200,000 from one of the following entitles: a) Commonwealth Government agency b) State or Territory Government c) Publicly Funded Research Organisation d) Investor registered as an Australian Venture Capital Limited Partnership or Early State Venture Capital Limited Partnership (AVCAL type membership) e) Specified Higher Education Provider · Under the agreement at least 10% of the funding must be payable to the entrepreneurial entity within 12 months of the day the activity starts to be undertaken in Australia; · You held at least 30% share ownership in your entrepreneurial entity when you entered into the agreement. · You have a business plan for the entrepreneurial entity noting how your innovative idea will lead to the commercialization of a product or service in Australia, or the development of an enterprise or business in Australia. |

| English | Competent level (minimum IELTS score 6.0 for each of the 4 bands;

OR passport from Ireland, UK, USA, Canada, NZ) |

| Validity of visa | 4 years and 3 months |

Key Issues to note:

- How best to manage the Expression of Interest (Eol) application process;

- How to seek State Nomination – given that each State/Territory governments have their own nomination criteria, and invitation by DIBP to apply for this visa is contingent upon State/Territory government nomination.

- How to prove that source of funds for investments

- Have been lawfully acquired.

- Are unencumbered , and

- How to provide documentary evidence regarding the source of these funds.

- How quickly the funds for investments can be transferred to Australia when requested by Dept. of Home Affairs prior to the 188 visa grant – when currency restrictions are in place for sme countries.

- How best to manage your investments in Australia so that you continue to meet the various investment criteria for the entire period of at least 4 years whilst holding your 188 visa and before you apply for your 888 Permanent Visa.

In summary:

The Business Innovation and Investor visas are highly complex visa categories. In the case of the Significant Investor Visa (SIV) and premium Investor Visa (PIV) Streams – both the 188 and 888 stages involve many third-party stake holders – including the States/Territory governments, Austrade, migration and financial advisors as well as the Department of Immigration. The challenge is for potential applicants to carefully identify experienced and ethical professionals who are able to plan and manage your visa applications and your Australian investments in a holistic manner in order to achieve the best outcome – i.e. permanent residence status in Australia and strong financial returns from your investments.

The reverse could be that you fail to obtain permanent residency and suffer financial losses at the end of 4 years (or 12 months, in the case of the PIV)! For these reason, we recommend that only expert registered Australian migration professionals and financial advisors should be used to safeguard your interests.

Co-Housing Australia

Co-Housing Australia

- Co-Housing Australia Webinar Series

- Banyule – Bellfield – Co-Housing

- Community-led Housing in the 21st Century

- Pathways to Finance Co-Housing / Collaborative Housing Projects

- Last Events of 2019

- Co-Housing Australia Strategic Plan Consultation

- Discussion: What’s the point of it all?

- Event: Sustainable Living Festival – Big Weekend

- Event: Housing for Degrowth

- Event: Doomsday prepping for the socially convivial

- Event: Our Housing Future is Collaborative

- Project Snapshot: Co-West Co-Housing

- Project Snapshot: Co-Housing Banyule

- Project Snapshot: WinC – Older Women in Co-Housing

- Project Snapshot: Moora Moora

- Project Snapshot: The Digs

- Project Snapshot: Urban Coup

Brisbane to outshine Sydney and Melbourne dwelling prices in 2020: Westpac

Brisbane to Outshine Sydney and Melbourne dwelling prices in 2020: Westpac

Brisbane dwelling prices will outperform those in Sydney and Melbourne in 2020, according to Westpac.

They believe the Queensland capital will see eight per cent increases next year, above the six forecasted for the two major capital city markets.

Westpac suggest the strong momentum in Sydney and Melbourne will fade as affordability issues re-emerge and population slows.

Brisbane is well positioned due to its affordability and population inflows.

“Momentum heading into 2020 is clearly positive, albeit uneven across markets,” Westpac advised.

They said in the near term, the main guidance comes from current price momentum, auction markets, listings and their buyer sentiment measures.

“Nationally, these are all showing positive prospects for early 2020 with price growth accelerating, auction clearance rates riding high in Sydney and Melbourne, listings showing a clear tightening and a positive pulse from buyer sentiment pointing to a further lift in demand.

“The cyclical momentum is strongest in Sydney and Melbourne but is also showing a notable pick up in Brisbane. Adelaide and Hobart are seeing a more muted lift with Perth yet to pull out of its multi year price decline.

Dwelling Prices: Actual and Forecast

| Average* | 2017 | 2018 | 2019e | 2020f | Comments | |

| Sydney | 5.1 | 3.2 | -8.9 | 4.1 | +6 | Strong Momentum fades as affordability issues re-emerge, population slows |

| Melbourne | 4.3 | 10.2 | -7.0 | 4.2 | +6 | Strong Momentum fades as affordability issues re-emerge, population flows |

| Brisbane | 0.9 | 1.8 | 0.2 | 1.0 | +8 | Gathering pace, well-placed in terms of affordability and likely population inflow |

| Perth | -1.5 | -1.7 | -4.7 | -6.8 | -0.5 | Closer to stabilizing but missing population & economic supports for recovery |

| Adelaide | 1.5 | 2.5 | 1.3 | -0.5 | +2 | Stable with some policy support but lacking economic drivers for stronger upturn |

| Hobart | 3.3 | 11.9 | 8.7 | 3.1 | +5 | Market remains very light meaning any lift in demand quick to stake price growth |

| Australia | 3.4 | 4.3 | -6.4 | 2.4 | +5 | Resurgence becoming more evenly balanced across markets |

All dwellings, Australia is five major capital cities combined measure; *10yr average

Source: CoreLogic, Westpac Economics

They predict a number of factors to shape residential property over 2020.

“The first is policy – we expect the RBA to cut rates by another 25bps at its February meeting and to turn to so-called unconventional policy measures to provide additional stimulus,” Westpac advise.

The second factor is supply, both in the form of sellers returning to the market and the physical supply of new dwellings. New listings fell to extreme lows in 2019.

“Our analysis suggests the listing cycle tends to follow the sales cycle by about six months. A likely lift in new listings will test the depth of demand in the first half of 2020. The supply of newly built dwellings will also remain elevated. Completions eased back from a record 218k in 2018 to an estimated 205k in 2019.

“Our projections have this easing to around 175k in 2020, still well above average pre-boom levels with about 50k of that high rise dwellings. New supply could prove difficult to absorb and will weigh on prices and rents in some segments – Sydney’s rental vacancy rate and Melbourne’s stock of unsold units being key areas to watch.

Westpac believe would-be buyers in Sydney and Melbourne will be priced out of the markets and will seek more affordable markets if the current price resurgence continues, which will slow growth.

“As 2020 unfolds we expect another dynamic to come to the fore around affordability and population flows.

“Despite the price correction in 2017-18 and a further lowering in interest rates, affordability remains relatively stretched in Sydney and Melbourne.

“The resurgence in prices see these markets run into the same affordability constraints that emerged in 2016-17 as prices near previous peaks.

“Investor activity will lift as low deposit rates and equity volatility drive more interest in real estate but funding is likely to remain a constraint on investors.”

Real Property Gains Tax (RPGT)

Real Property Gains Tax (RPGT)

A. DETERMINATION OF ACQUISITION PRICE FOR DISPOSAL OF REAL PROPERTY ACQUIRED PRIOR TO 1 JANUARY 2013

Existing Legislation

Effective from 1 January 2019, in the case of a disposal of real property acquired prior to 1 January 2000, the acquisition price of such real property for the purpose of determining the chargeable gain subject to Real Property Gains Tax shall be the market value of the real property as at 1 January 2000. The disposer must be a Malaysian citizen or permanent resident.

Proposed Legislation

It is proposed that the determination of market value as of 1 January 2000 as the acquisition price for the disposal of real properties acquired before year 2000 be amended to the market value as of 1 January 2013 as the acquisition price for the disposal of real properties acquired prior to year 2013 for the purpose of Real Property Gains Tax computation.

Reference

Schedule 2 and 3 of the Real Property Gains Tax Act 1976.

Effective Date

For the disposal of real properties from 12 October 2019.

Likely Tax effects and Implications

In consideration of the public’s view, the Government has introduced this measure to reduce the Real Property Gains Tax exposure on the disposal of real properties by Malaysian citizens and permanent residents after 5 years from the date of acquisition.

B. RETENTION SUM BY ACQUIRED FOR DISPOSAL OF CHARGEABLE ASSET BY A COMPANY NOT INCORPORATED IN MALAYSIA

Existing Legislation

Presently, where the disposer of chargeable assets (i.e. real property or shares in a real property company) is not a Malaysian citizen and not a permanent resident, and the consideration for the disposal consists wholly or partly of money, the acquirer is required to withhold either the whole of that money or a sum not exceeding 7% of the total value of the consideration, whichever is lower, and remit the sum withheld to the Inland Revenue Board (IRB) within 60 days after the date of disposal.

Proposed Legislation

It is proposed that the above requirement be extended to the disposal of a chargeable asset by a company not incorporated in Malaysia.

Reference

Section 21B (1A) of the Real Property Gains Tax Act 1976.

Effective Date

Upon coming into operation of the Finance Act 2019.

Likely Tax Effects and Implications

This amendment would require the acquirer to withhold and remit a sum not exceeding 7% of the consideration relating to the disposal of a chargeable asset by a company not incorporated in Malaysia.

C. CHANGES IN REAL PROPERTY GAINS TAX RATES APPLICABLE TO DISPOSAL OF CHARGEABLE ASSET BY A COMPANY NOT INCORPORATED IN MALAYSIA AND A TRUSTEE OF A TRUST

Existing Legislation

Presently, gains from the disposal of chargeable assets (i.e. real property or shares in a real property company) are taxed under the Real Property Gains Tax Act 1976. The current effective Real Property Gains Tax rates range from 5% to 30%, depending on who the disposer is and the holding period of the chargeable asset, and they are as follows:

| Date of Disposal | Real Property Gains Tax Rates | ||

| Companies | Individual (Citizen / Permanent Resident) | Individual (Non-Citizen / Non-Permanent Resident) | |

| Within 3 years from date of acquisition | 30% | 30% | 30% |

| In the 4th year | 20% | 20% | 30% |

| In the 5th year | 15% | 15% | 30% |

| In the 6th year and subsequent years | 10% | 5% | 10% |

Proposed Legislation

It is proposed that the Real Property Gains Tax rates affecting the disposal of chargeable assets by a company not incorporated in Malaysia and a trustee of a trust be revised as follows:

| Date of Disposal | Real Property Gains Tax Rates | ||

| Companies Incorporated in Malaysia or a Trustee of a trust | Individual (Citizen / Permanent Resident) | Individual (Non-Citizen / Non-Permanent Resident) or a Company Not Incorporated in Malaysia | |

| Within 3 years from date of acquisition | 30% | 30% | 30% |

| In the 4th year | 20% | 20% | 30% |

| In the 5th year | 15% | 15% | 30% |

| In the 6th year and subsequent years | 10% | 5% | 10% |

Reference

Part II AND III of Schedule 5 of the Real Property Gains Tax Act 1976.

Effective Date

Upon coming into operation of the Finance Act 2019.

Likely Tax Effects and Implications

This amendment seeks to change the Real Property Gains Tax rates applicable to gains on disposal of chargeable assets by a company not incorporated in Malaysia and a trustee of a trust.

2020 Review of Income Tax Rates and Income Tax Structure

Review of Income Tax Rates and Income Tax Structure

Existing Legislation

Presently, the income tax for resident individual taxpayer is calculated based on scale rates ranging from 0% to 28% with the maximum rate of 28% being applicable to the chargeable income band of RM1,000,000 and above.

For non-resident individual taxpayer, the income tax rate is at 28%.

Proposed Legislation

It is proposed that chargeable income band exceeding RM 2,000,000 be introduced and the tax rate for resident individual taxpayer for chargeable income exceeding RM2,000,000 be increased by 2% as follows:

| Chargeable Income (RM) | Existing Rates (%) | Proposed Rates (%) | Increase (%) |

| 0 – 5,000 | 0 | 0 | – |

| 5,001 – 20,000 | 1 | 1 | – |

| 20,001 – 35,000 | 3 | 3 | – |

| 35,001 – 50,000 | 8 | 8 | – |

| 50,001 – 70,000 | 14 | 14 | – |

| 70,001 – 100,000 | 21 | 21 | – |

| 100,001 – 250,000 | 24 | 24 | – |

| 250,001 – 400,000 | 24.5 | 24.5 | – |

| 400,001 – 600,000 | 25 | 25 | – |

| 600,001 – 1,000,000 | 26 | 26 | – |

| 1,000,001 – 2,000,000 | 28 | 28 | – |

| Above 2,000,000 | 28 | 30 | 2 |

It is proposed that non-resident individual taxpayer’s income tax rate be increased by 2% from 28% to 30%.

Reference

Schedule 1 Part 1 Paragraphs 1 and 1A of the Income Tax Act 1967.

Effective Date

From year of assessment 2020.

Likely Tax Effects and Implications

- The Monthly Tax Deduction (MTD) table applicable to tax deductions in 2020 will have to be revised by the tax authorities to take into account the increase and change in the structure in income tax rates.

- The proposed resident tax rates are tabulated as below:

| Chargeable income brackets | Present tax rate

(%) |

Proposed tax rate

(%) |

Present tax payable

(RM) |

Proposed tax payable

(RM) |

|

| (RM) | |||||

| On the first

On the next |

5,000

5,000 |

0

1 |

0

1 |

0

50 |

0

50 |

| On the first

On the next |

10,000

10,000 |

1 | 1 | 50

100 |

50

100 |

| On the first

On the next |

20,000

15,000 |

3 | 3 | 150

450 |

150

450 |

| On the first

On the next |

35,000

15,000 |

8 | 8 | 600

1,200 |

600

1,200 |

| On the first

On the next |

50,000

20,000 |

14 | 14 | 1,800

2,800 |

1,800

2,800 |

| On the first

On the next |

70,000

30,000 |

21 | 21 | 4,600

6,300 |

4,600

6,300 |

| On the first

On the next |

100,000

150,000 |

24 | 24 | 10,900

36,000 |

10,900

36,000 |

| On the first

On the next |

250,000

150,000 |

24.5 | 24.5 | 46,900

36,750 |

46,900

36,750 |

| On the first

Exceeding |

400,000

200,000 |

25 | 25 | 83,650

50,000 |

83,650

50,000 |

| On the first

Exceeding |

600,000

400,000 |

26 | 26 | 133,650

104,000 |

133,650

104,000 |

| On the first

Exceeding |

1,000,000

1,000,000 |

28 | 28 | 237,650

280,000 |

237,650

280,000 |

| On the first

Exceeding |

2,000,000

2,000,000 |

28 | 30 | 517,650 | 517,650 |

Business Migration and Investment Visa Pathways for All Countries

AUSTRALIA

| Business Migration and Investment Visa Pathways for Australia | ||||

| Provisional | Permanent | |||

| VISA Class | Business Innovation

188 (A) |

Investor Stream

188 (B) |

Significant Investor Stream 188 (C) | Business Talent Visa

132 (A) |

| Net Assets | AUD$800k | AUD$2.25m | AUD$5m | AUD$1.5m (at least AUD$400k in business assets |

| Proof: Source of Funds | 2 years | 2 fiscal years | Yes | 2 years |

| Business Turnover | AUD$500k for at least 2 of the last 4 fiscal years | NA | NA | AUD$ 3m for at least 2 of the last 4 fiscal years |

| Company Ownership | ≥ 30% | NA | NA | 10% (if PLC) or ≥ 30% |

| Amount of Investment | AUD$200k | AUD$1.5m for 4 years

(Government Bonds) |

AUD$5m for 4 years

(Fund Management) |

AUD$1m or AUD$1.5m for land development |

| Length of VISA | 4 years provisional visa | 4 years provisional visa | 4 years provisional visa | 5 years

(renewable) |

| Getting PR | Apply for 888 after running a successful business for 2 years | Apply for 888 after bond matures in 4 years | Apply for 888 after maintaining investment fund for 4 years | NA |

| Minimum Required Stay | 1 out of 2 years | 2 out of 4 years | 40 days each year for 4 years | NA |

| Other Requirements | ||||

| Age Limit | 55 years old* | 55 years old* | No age limit | 55 years old* |

| Managerial Experience | 2 years minimum | 2 years minimum | NA | 2 years minimum |

| Points Test | 65 points | 65 points | NA | NA |

| English Test | IELTS 4.5* | IELTS 4.5* | NA | IELTS 4.5* |

| Investment Options | Financial Planning (600k)

Medical Services F&B (300k) |

Government Bond | Fund Management | Financial Planning

Medical Services Land Development |

*Can be waived subject to conditions

Visa Information on: BUSINESS VISA AS IN AUSTRALIA >> Read More

2019 – 2020 新财年移民配额变化 2019-2020 Migration Program Planning Levels >> Read More

CANADA

| Business Migration and Investment Visa Pathways for Canada | ||

| VISA Class | Entrepreneur | Investor |

| Net Assets | CAD$600k | CAD$2.0m |

| Proof: Source of Funds | Yes | Yes |

| Business Turnover | NA | NA |

| Amount of Investment | CAD$150k | Option1: CAD$1.2m for 5 years with no interest

Option 2: CAD$330k paid to bank |

| Length of VISA | 2 years work visa | 5 years PR (renewable) |

| Getting PR | Apply for PR after 1 year of business | NA |

| Minimum Required Stay | 1 out of 2 years | 2 out of 5 years |

| Other Requirements | ||

| Age Limit | NA | NA |

| Managerial Experience | 3 or 5 years | 2 years |

| Points Test | TBC | TBC |

| English Test | CLB 5 | CLB 5 |

USA

| Business Migration and Investment Visa Pathways for USA | |

| VISA Class | EB-5 |

| Net Assets | USD$1m |

| Proof: Source of Funds | 7 years |

| Business Turnover | NA |

| Amount of Investment | USD$500k for 5 years minimum |

| Length of VISA | 2 years conditional green card |

| Getting PR | Remove conditions |

| Minimum Required Stay | Visit once every six months |

| Other Requirements | |

| Age Limit | NA |

| Managerial Experience | NA |

| Points Test | NA |

| English Test | NA |

CYPRUS

| Business Migration and Investment Visa Pathways for Cyprus | |

| VISA Class | Citizenship |

| Net Assets | NA |

| Proof: Source of Funds | NA |

| Business Turnover | NA |

| Amount of Investment | EUR$2m |

| Length of VISA | Citizenship |

| Getting PR | NA |

| Minimum Required Stay | NA |

| Other Requirements | |

| Age Limit | NA |

| Managerial Experience | NA |

| Points Test | NA |

| English Test | NA |

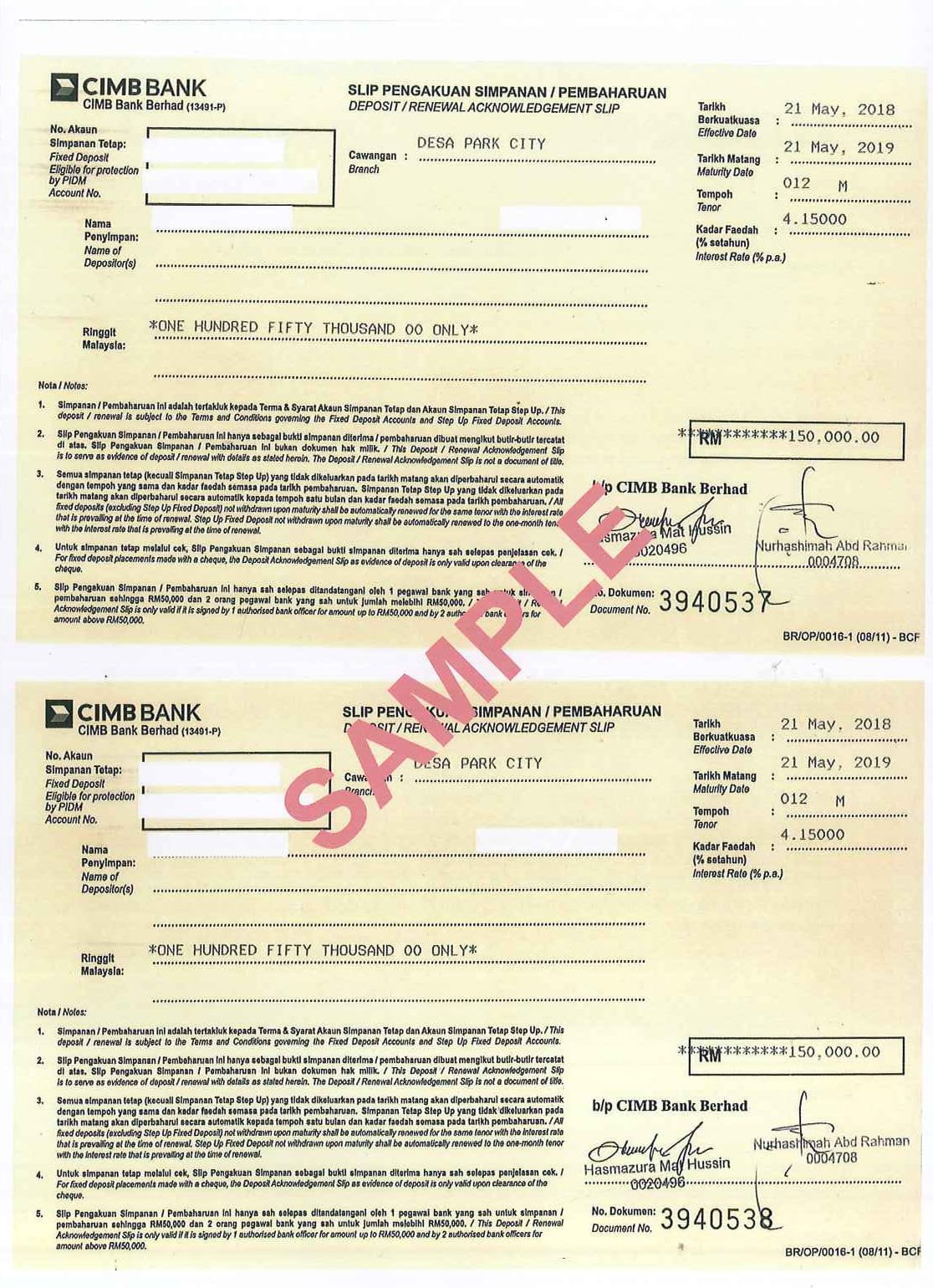

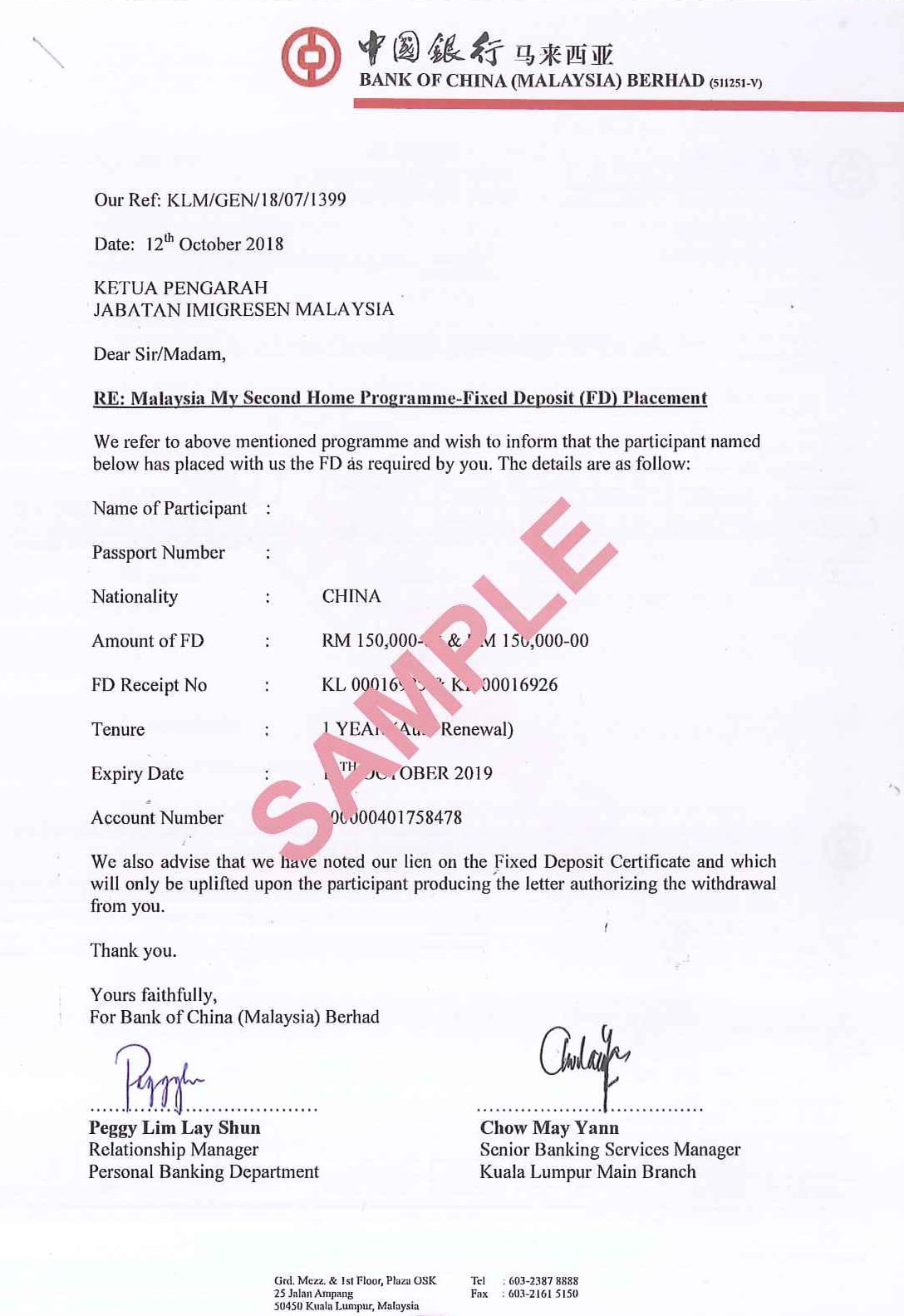

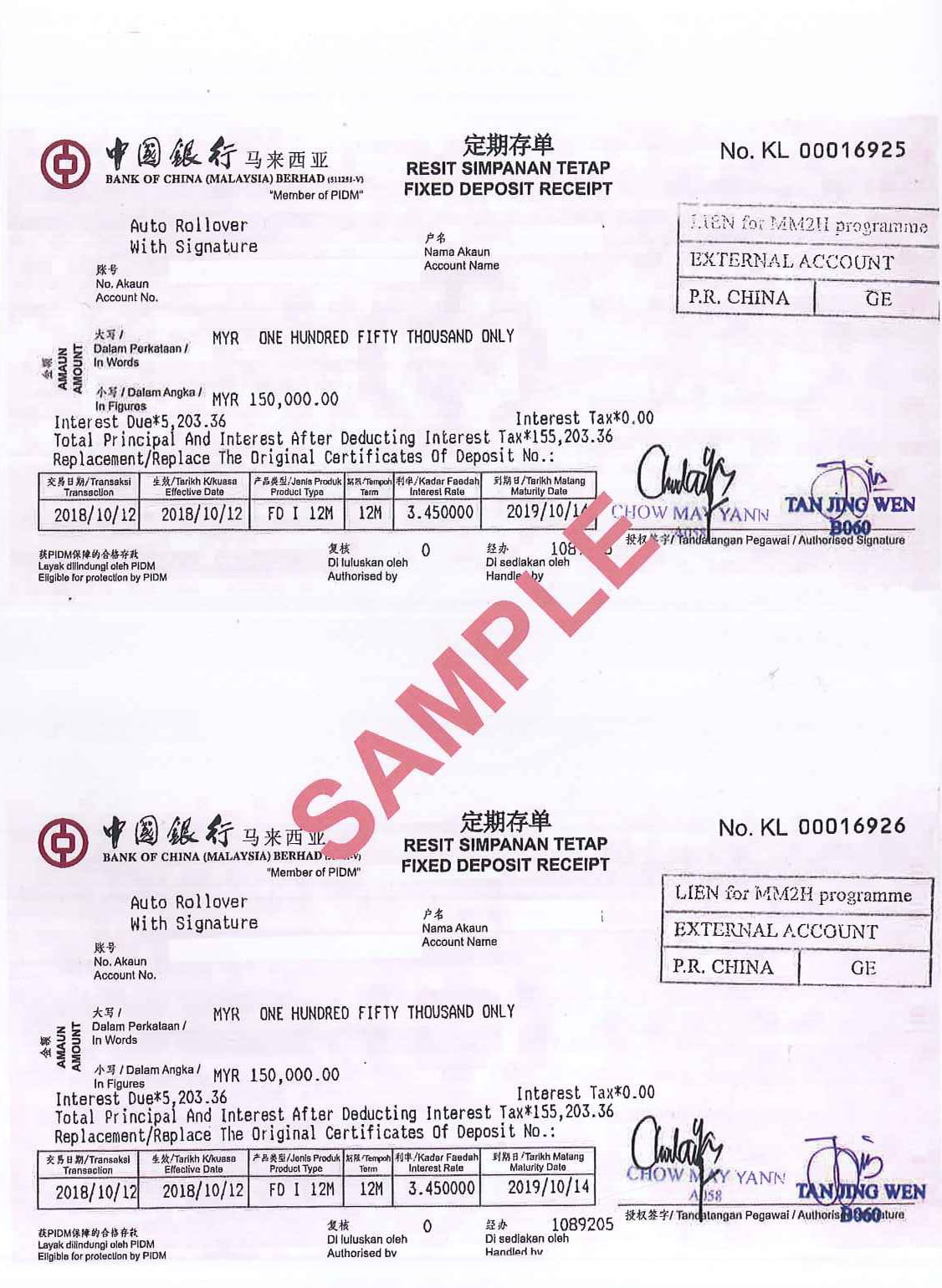

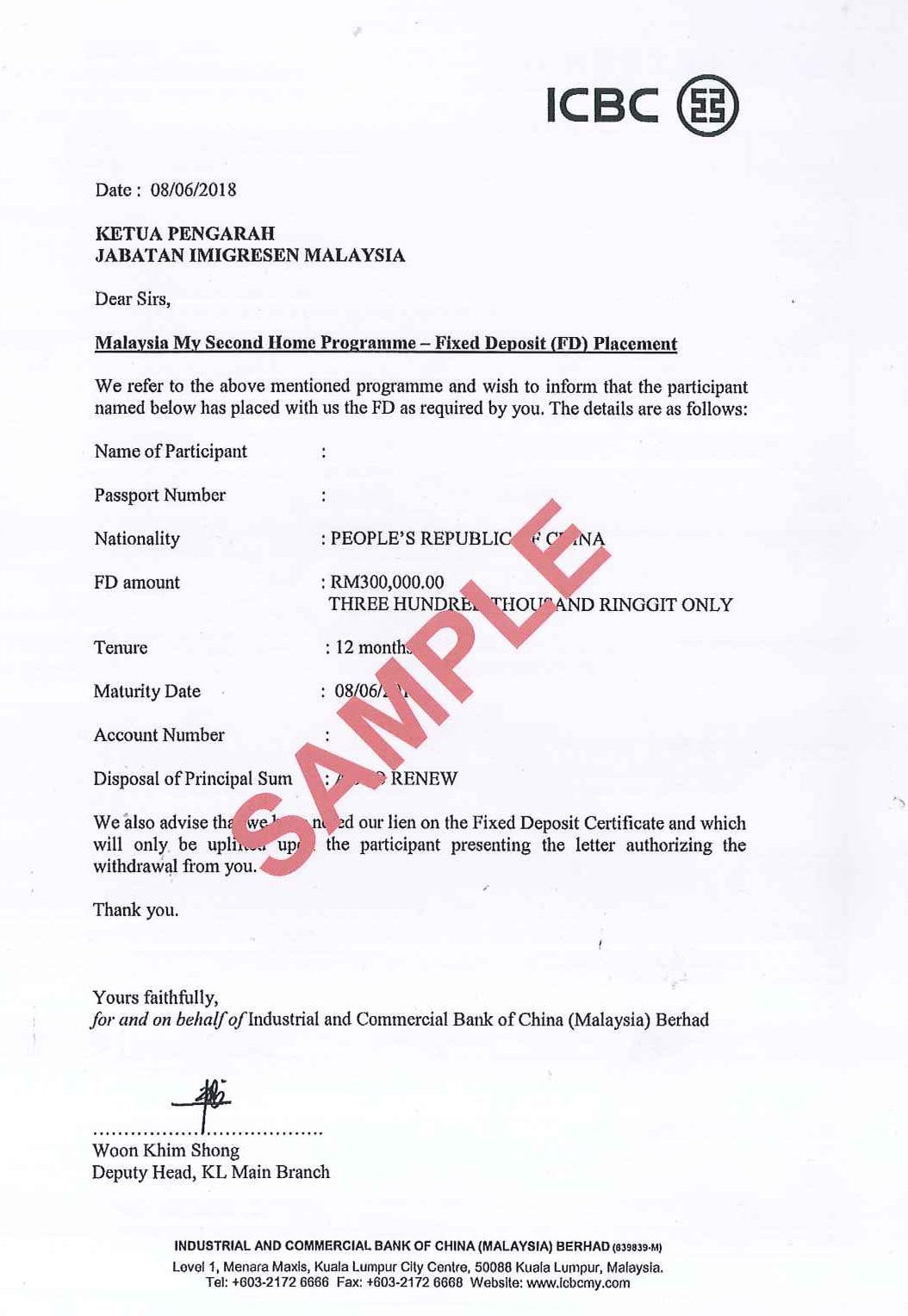

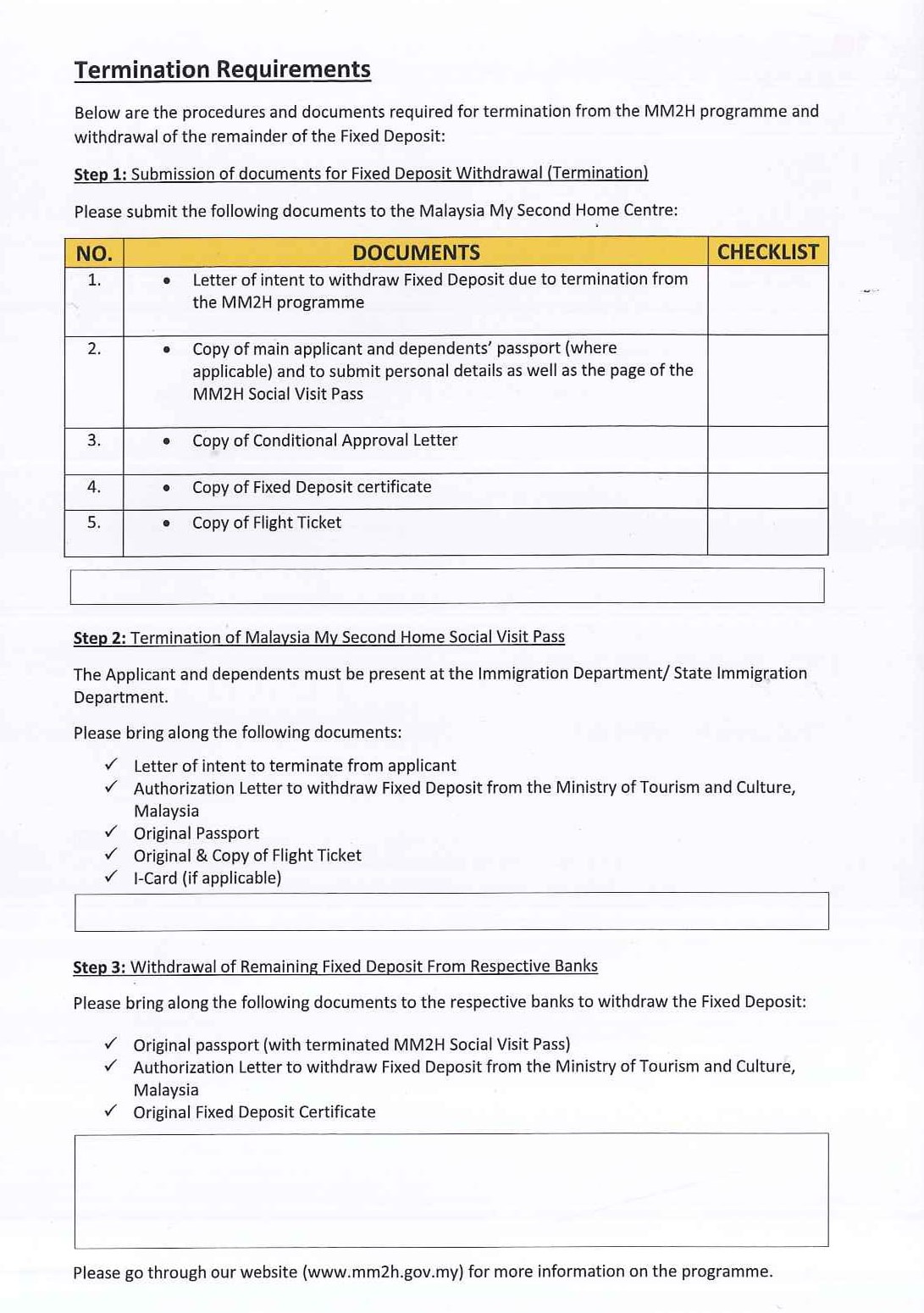

MM2H Fees Structure

Summerfield MM2H’s Plan A & B

MM2H Fee Structure

Please select a Plan according to the services you need for your MM2H application.

| PLAN-A

For Age 60 & Above Only |

PLAN-B

COMPLETE NEW MM2H |

PLAN-C

SUSPENDED |

||

| FEE IN RM | MAIN APPLICANT | 9000 | 10000 | 12000 |

| PER DEPENDENT | 1000 | 1000 | 1000 | |

| With Documents in English Only. | ||||

| REFER TO CHART BELOW FOR DETAILS | A | B | C | |

| MODE OF PAYMENT (in RINGGIT MALAYSIA) | ||||

| STAGE-ONE | As per MAAA | As per MAAA | As per MAAA | |

| STAGE-TWO | Balance of Fee | Balance of Fee | Balance of Fee | |

Agent Appointment Fee @ RM 2000 is due after we receive the signed MAAA.

(MAAA = MM2H Agent Appointment Agreement)

This is to ensure that clients who appoint Summerfield MM2H as their MM2H Agent are genuine.

This AA fee is part of our total fee stated in the signed MAAA.

Our Scope of Services for each Selected Plan

| STAGE-ONE : Plan A, B & C – MM2H Application | A | B | C |

| 1. Provide up to date information on the terms and conditions of MM2H Programme. | √ | √ | √ |

| 2. Evaluate applicant’s eligibility for the MM2H Application via our MM2H Online Assessment. | √ | √ | √ |

| 3. Provide detailed MM2H Checklist designed for easy reference of all required documents for a successful MM2H Application. | √ | √ | √ |

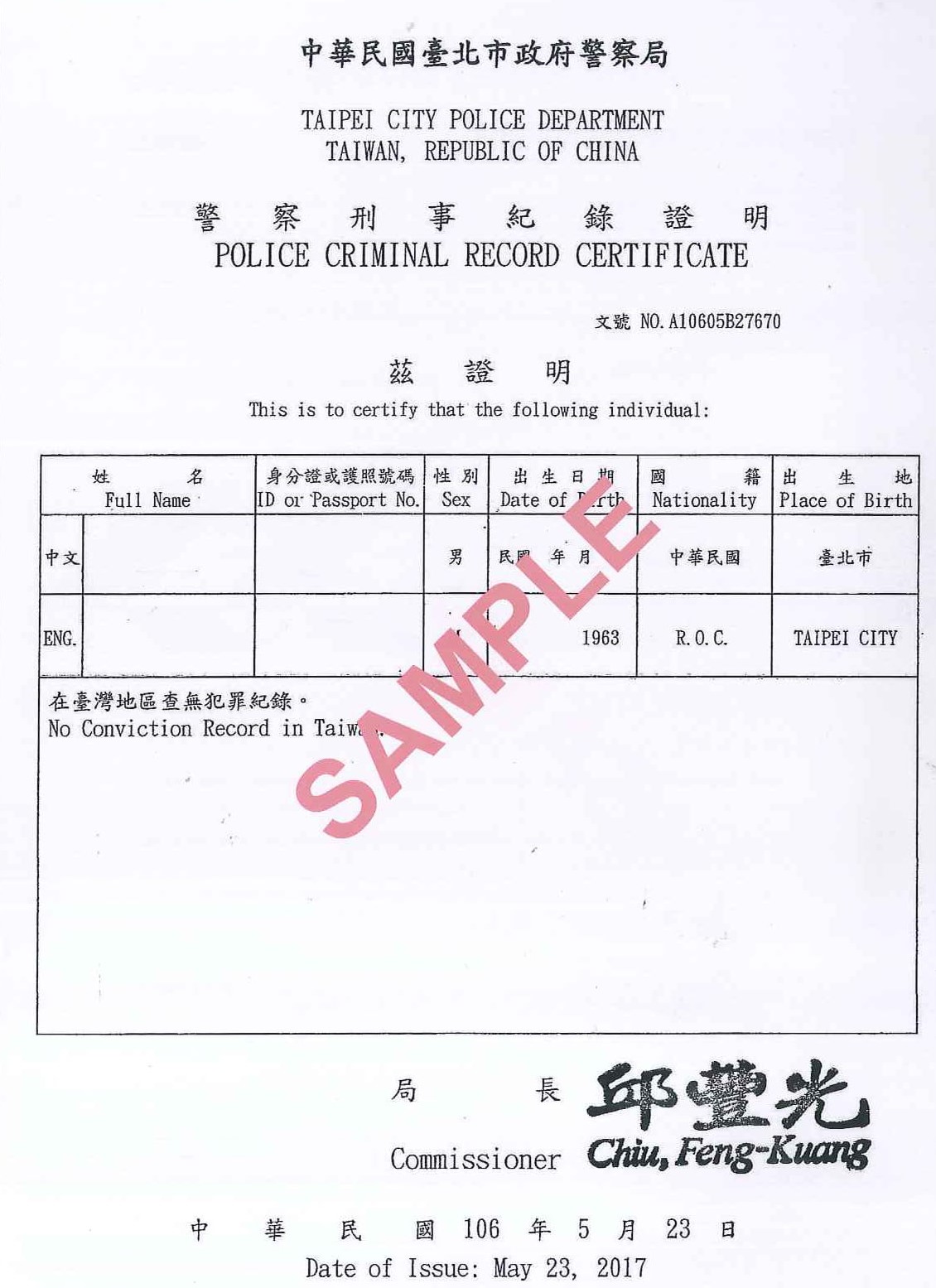

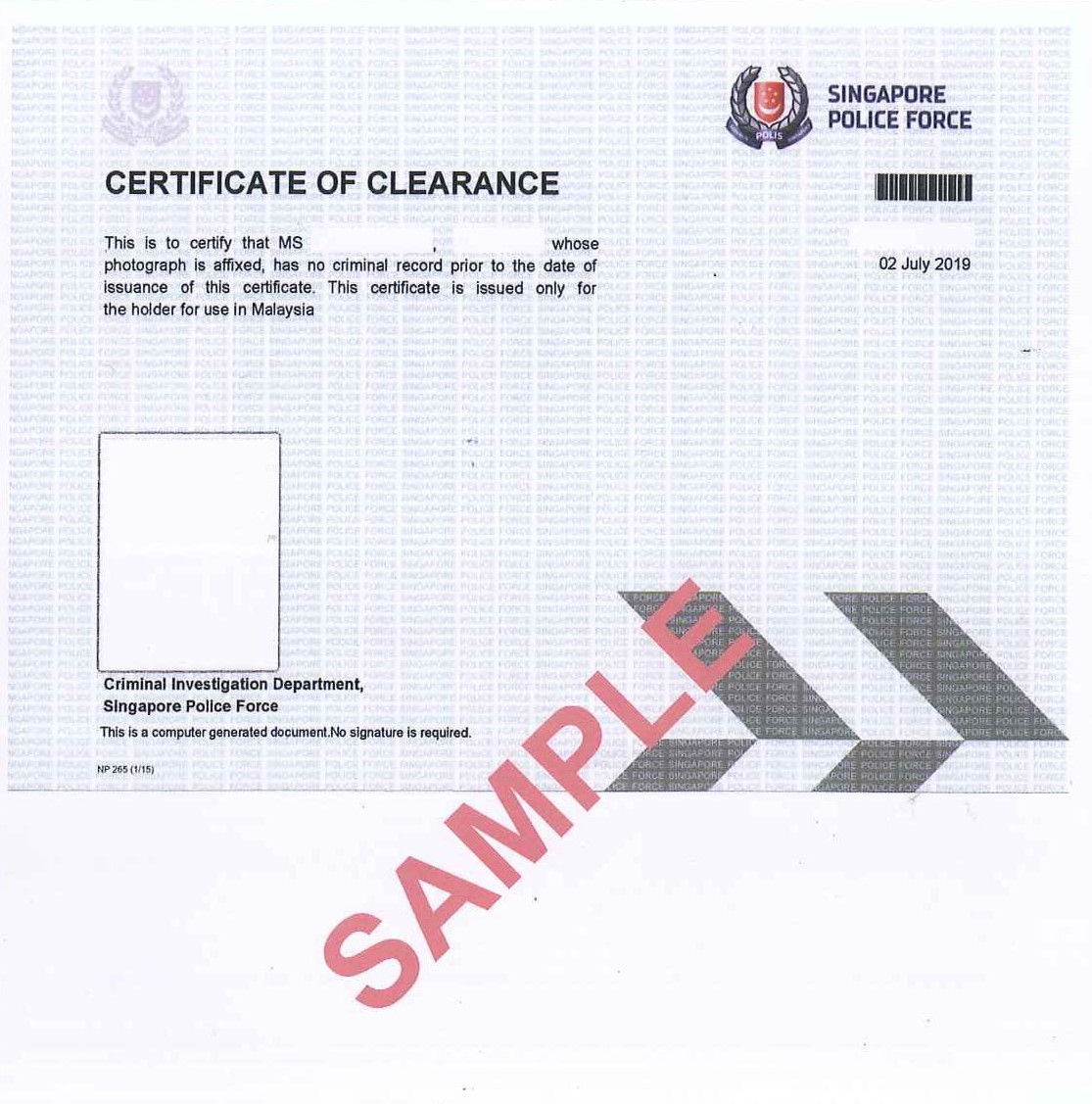

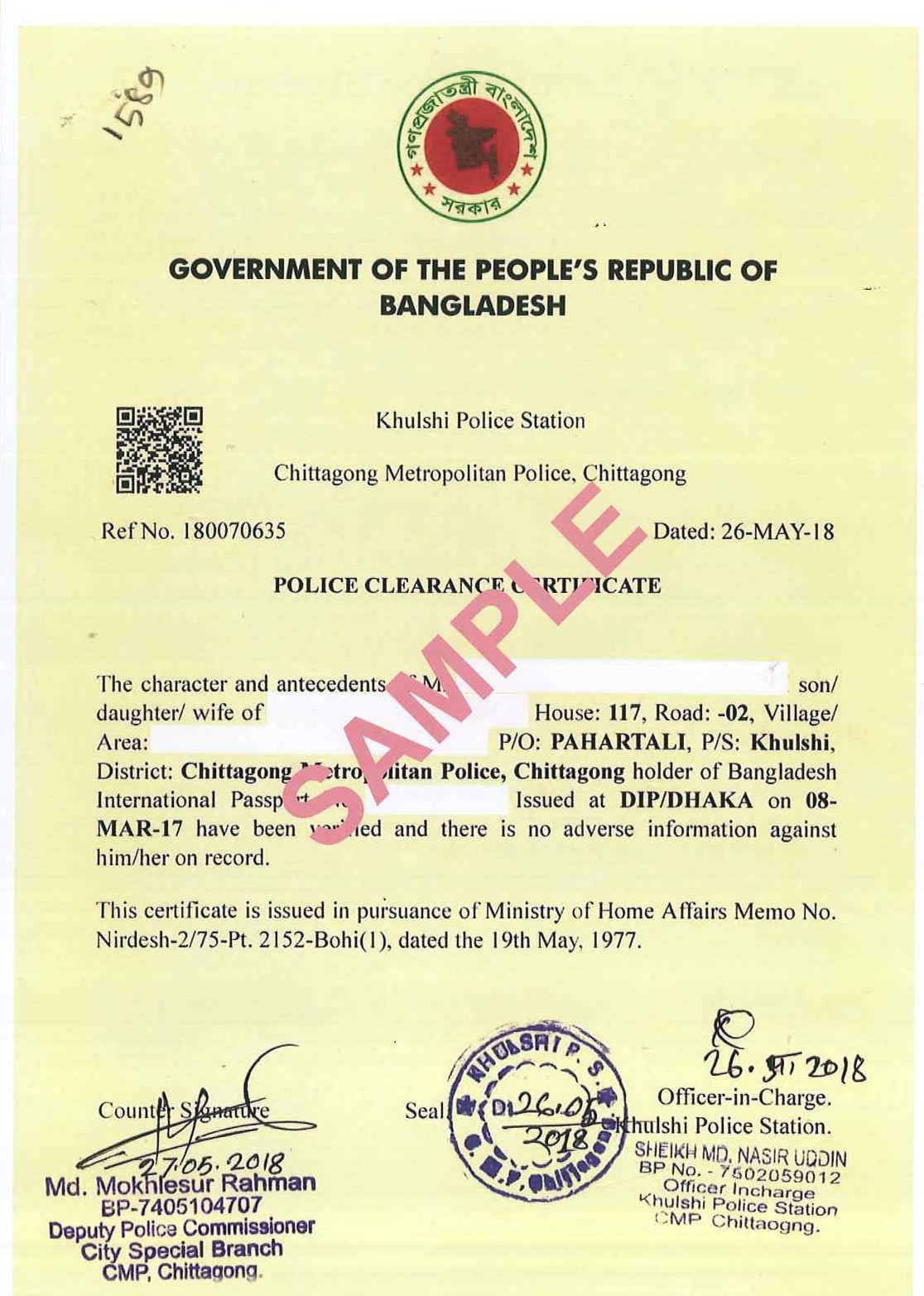

| 4. Provide samples of required documents for reference. | √ | √ | √ |

| 5. Guide applicant to prepare the complete documents as per Ministry’s requirements. | √ | √ | √ |

| 6. Review & confirm documents are complete prior to delivery to us for the formal submission. | √ | √ | √ |

| 7. Fee Due @ Submission – Applicant is to remit the fee to our bank account as per selected Plan. | √ | √ | √ |

| 8. Upon receipt of fee & complete documents, we prepare documents on our part as agent/sponsor including the Personal Bond(s) signed with stamp duties paid or applicants as required by the Immigration Department of Malaysia. (No deposits are required). | √ | √ | √ |

| 9. Submit application to the Ministry of Tourism (MoTour). | √ | √ | √ |

| 10. Email applicant the official receipt of submission from MoTac. As of to date, from the date of submission, the Ministry takes up to 5 to 7 months to process and to approve the applications. | √ | √ | √ |

| 11. Follow-up with the Ministry concerning the status of the application. | √ | √ | √ |

| 12. In the unlikely event that the application is being declined, appeals will be submitted to the Ministry until the issuance of MM2H Conditional Approval Letter (MCAL). | √ | √ | √ |

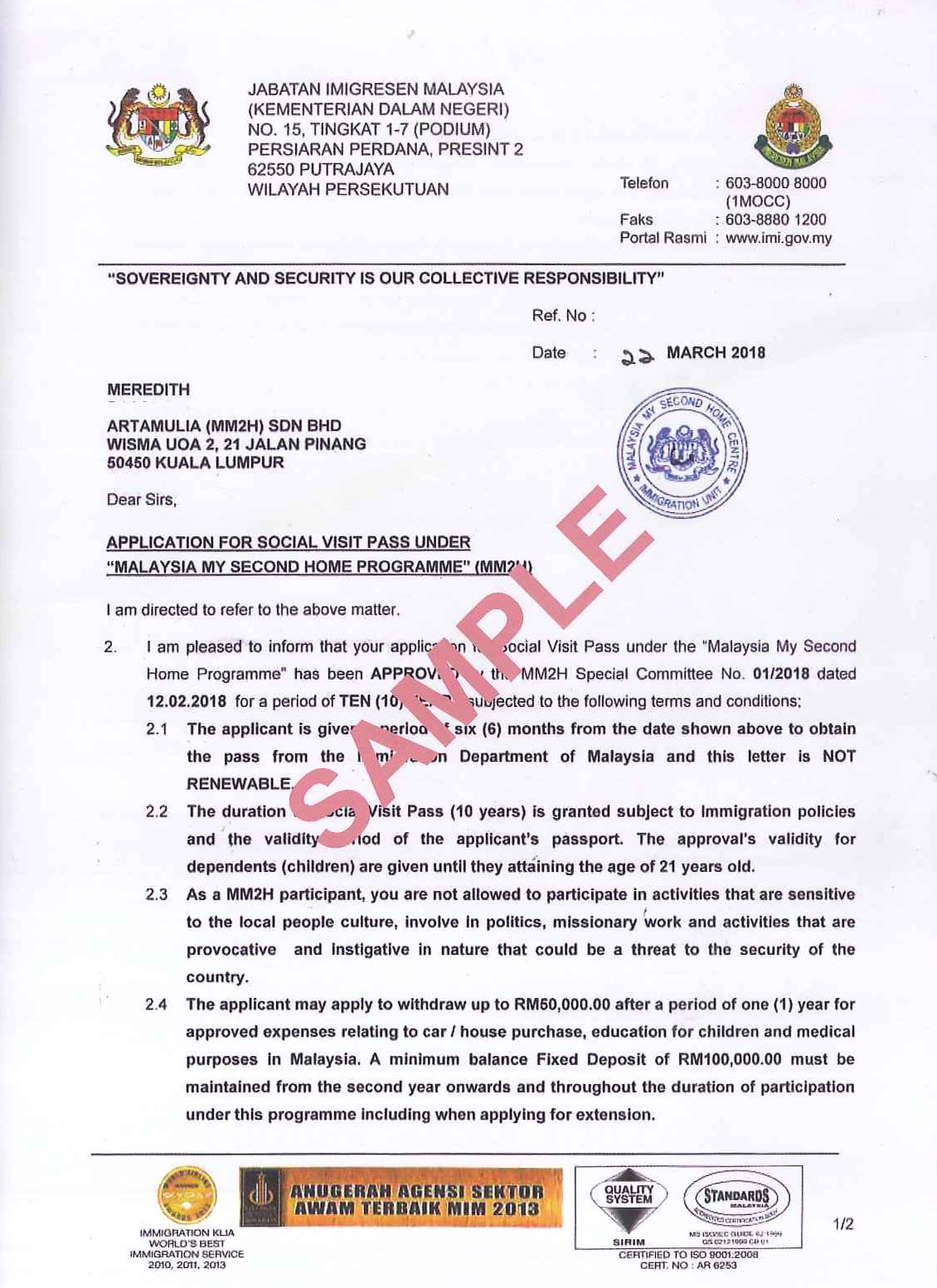

| 13. Upon approval, we will email applicant the MM2H Conditional Approval Letter. Applicant is to schedule visit to Kuala Lumpur to complete all conditions & to obtain the MM2H Pass & Visa Endorsement(s). Guidance will be provided for Steg-Two Procedures. | √ | √ | √ |

| STAGE-TWO : Plan A, B & C – MM2H Approval | A | B | C |

| 1. Applicants (& family, if applicable) are to visit Kuala Lumpur within 6 months from the issuance date of the MCAL to fulfil the conditions set by the Immigration of Malaysia as below:

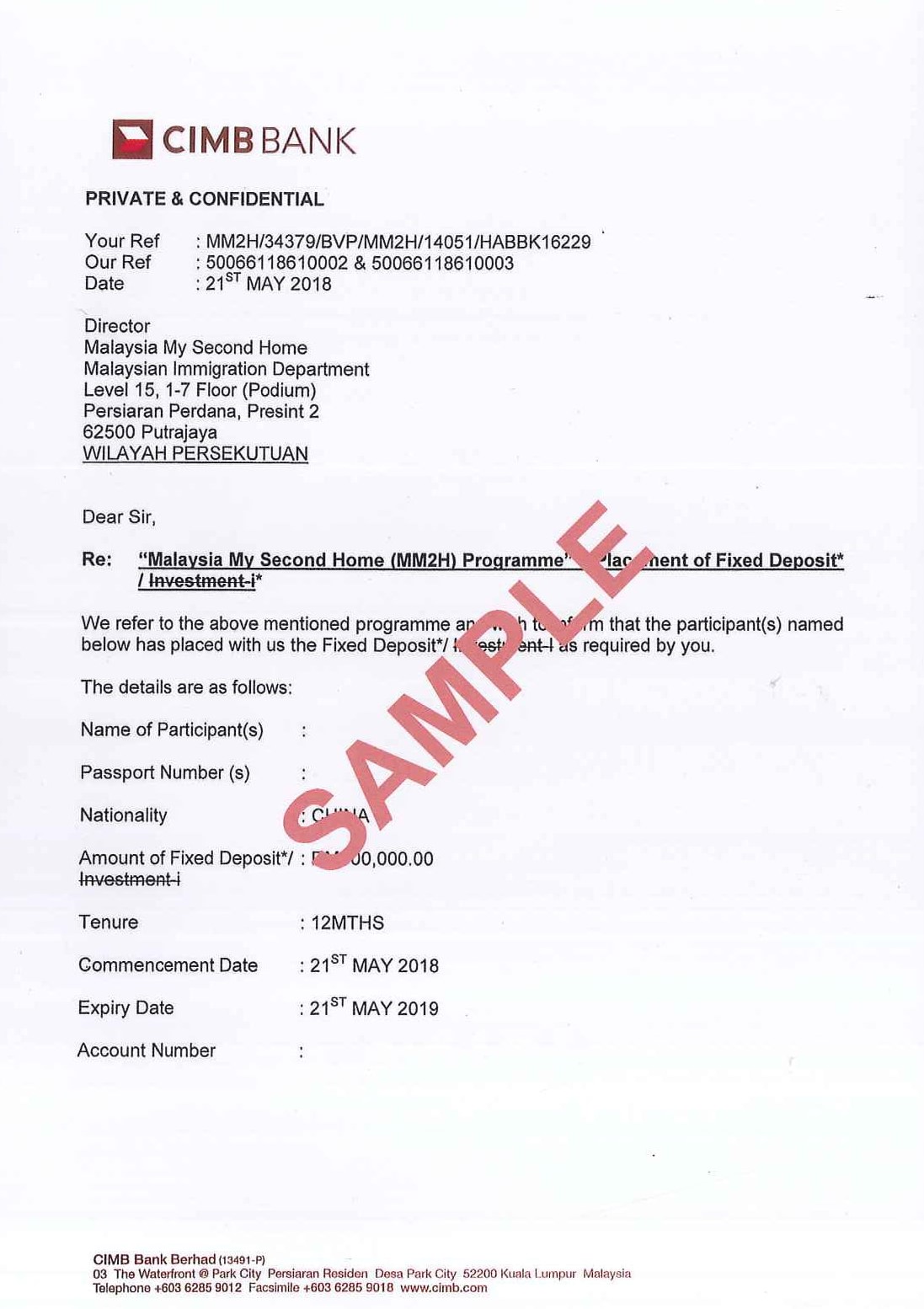

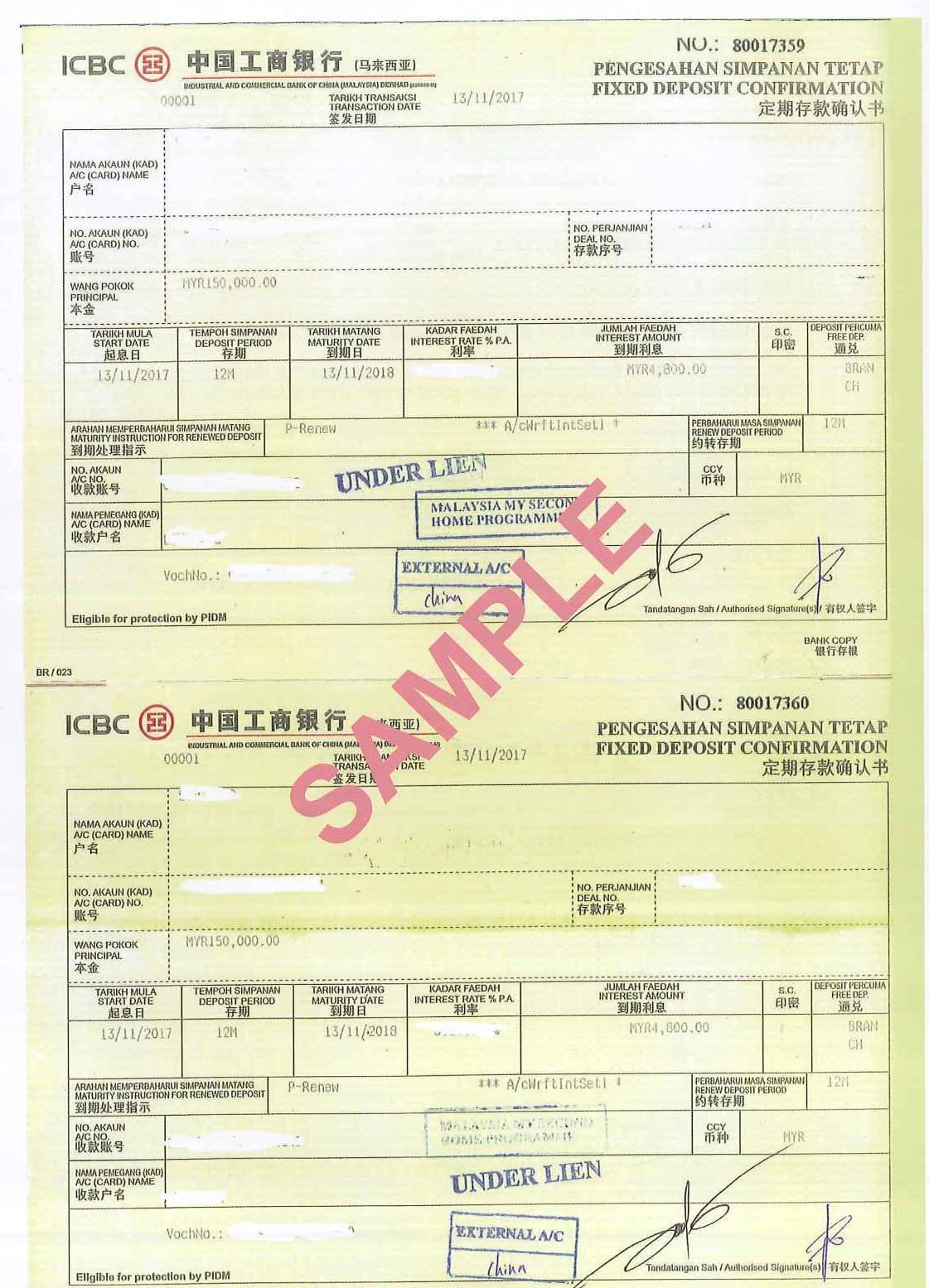

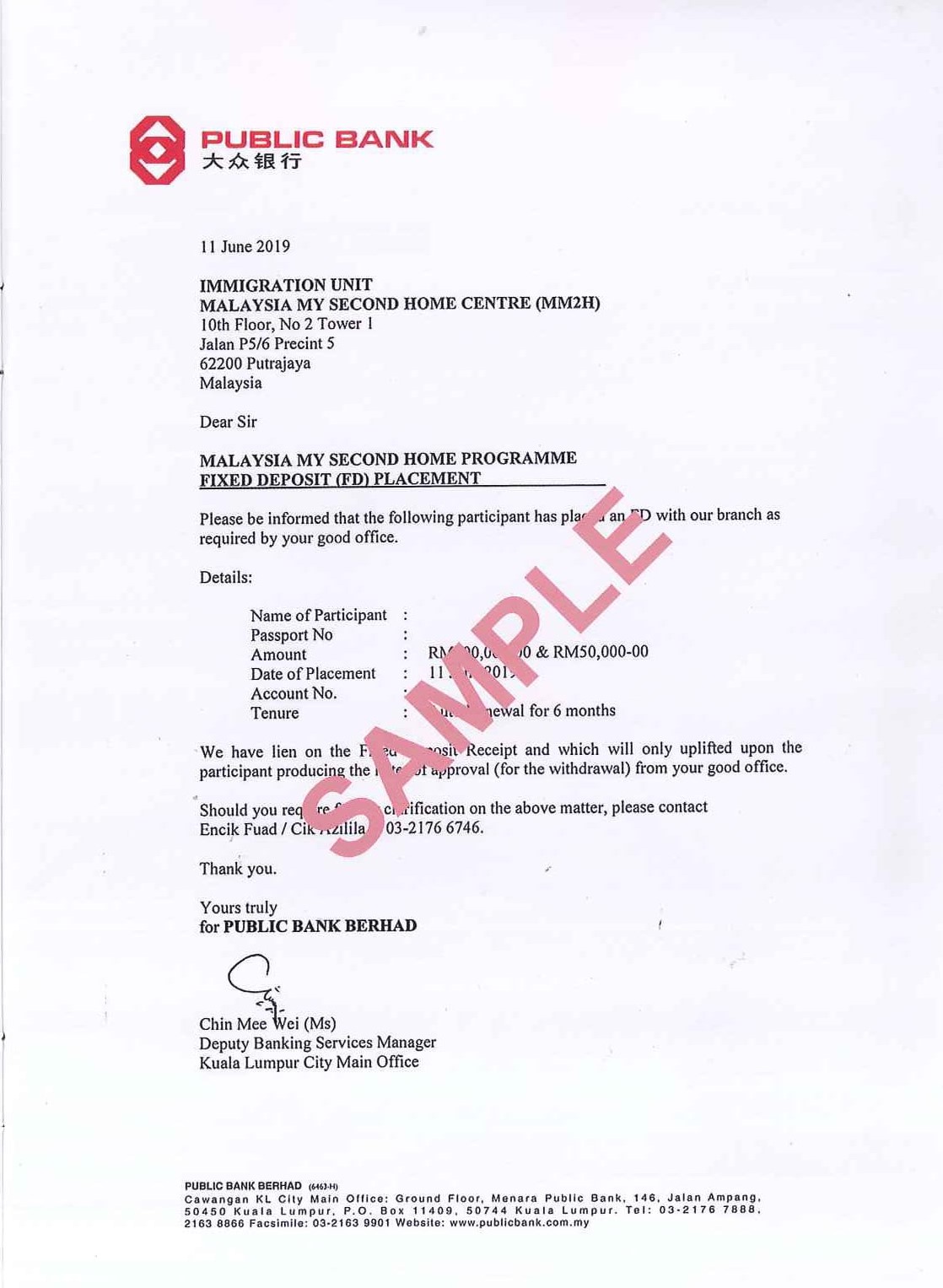

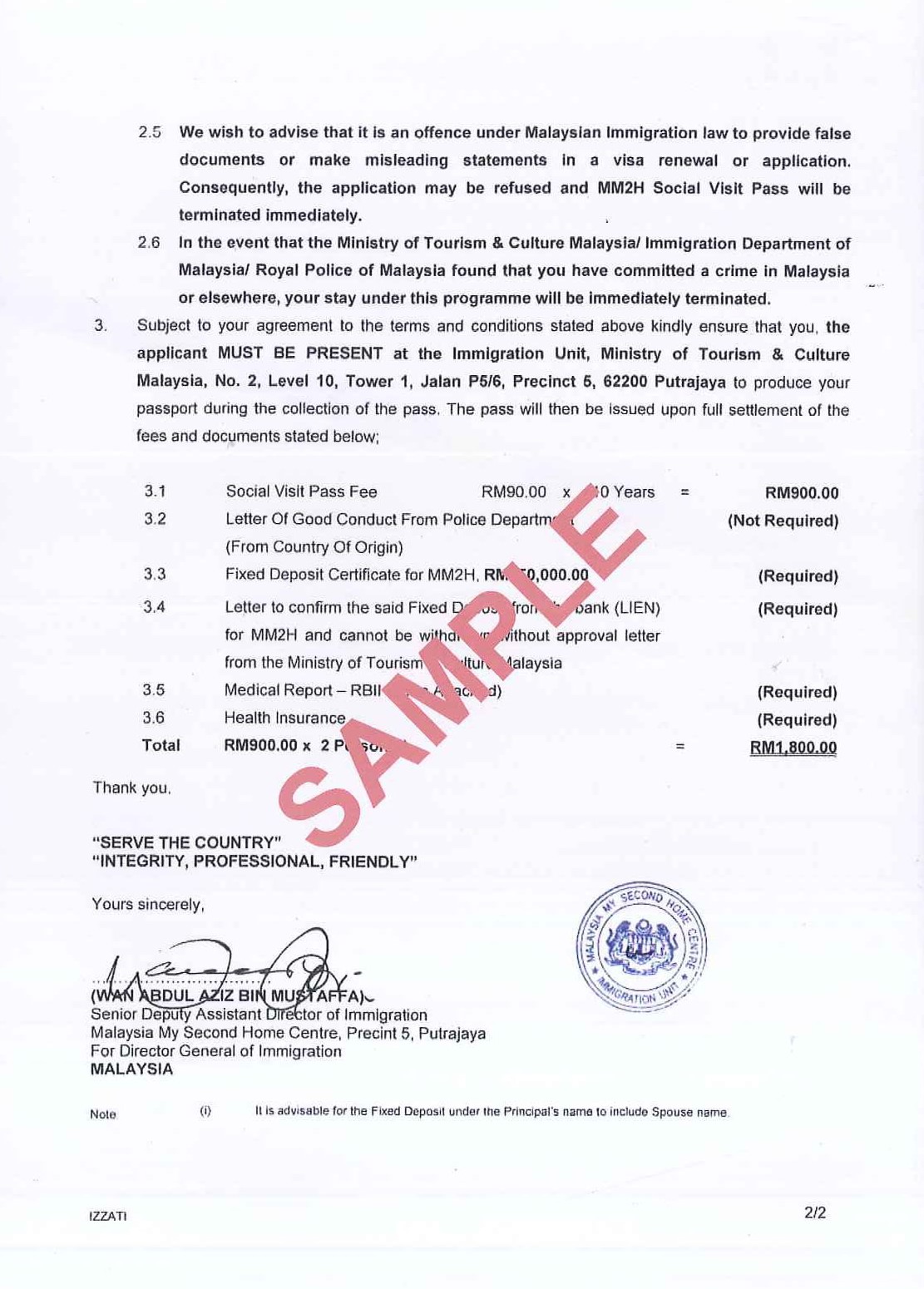

a. Assist to complete Medical Check-up at selected clinic. b. Assist to purchase Medical Insurance for each participant as per requirement with our selected insurance company; (Insurance Premium payable to Insurance Company). c. Fixed Deposit Placement – Applicant are allowed to place the required Fixed Deposit with any bank in Malaysia. – The Fixed Deposit must be under lien with auto-renewal for 10 years. – Withdrawal of Fixed Deposit must have prior approval from Ministry of Tourism Malaysia. |

√ | √ | √ |

| 2. After completion of the above conditions, we will be present with the applicants at MM2H Immigration Unit, Putrajaya to submit the required documents, to pay visa fee charges (with cash) and to obtain MM2H Pass & Visa endorsement(s). | √ | √ | √ |

| 3. Balance of Fee Due to us – Upon receipt of the MM2H Pass & Visa endorsements, applicant is to settle of the balance of the fee due to us according to the selected plan. | √ | √ | √ |

| ADDITIONAL SERVICES : | |||

| 4. Apply to extend “MM2H Conditional Approval Letter” for applicant with valid reason (One time)**. | AH | AH | AH |

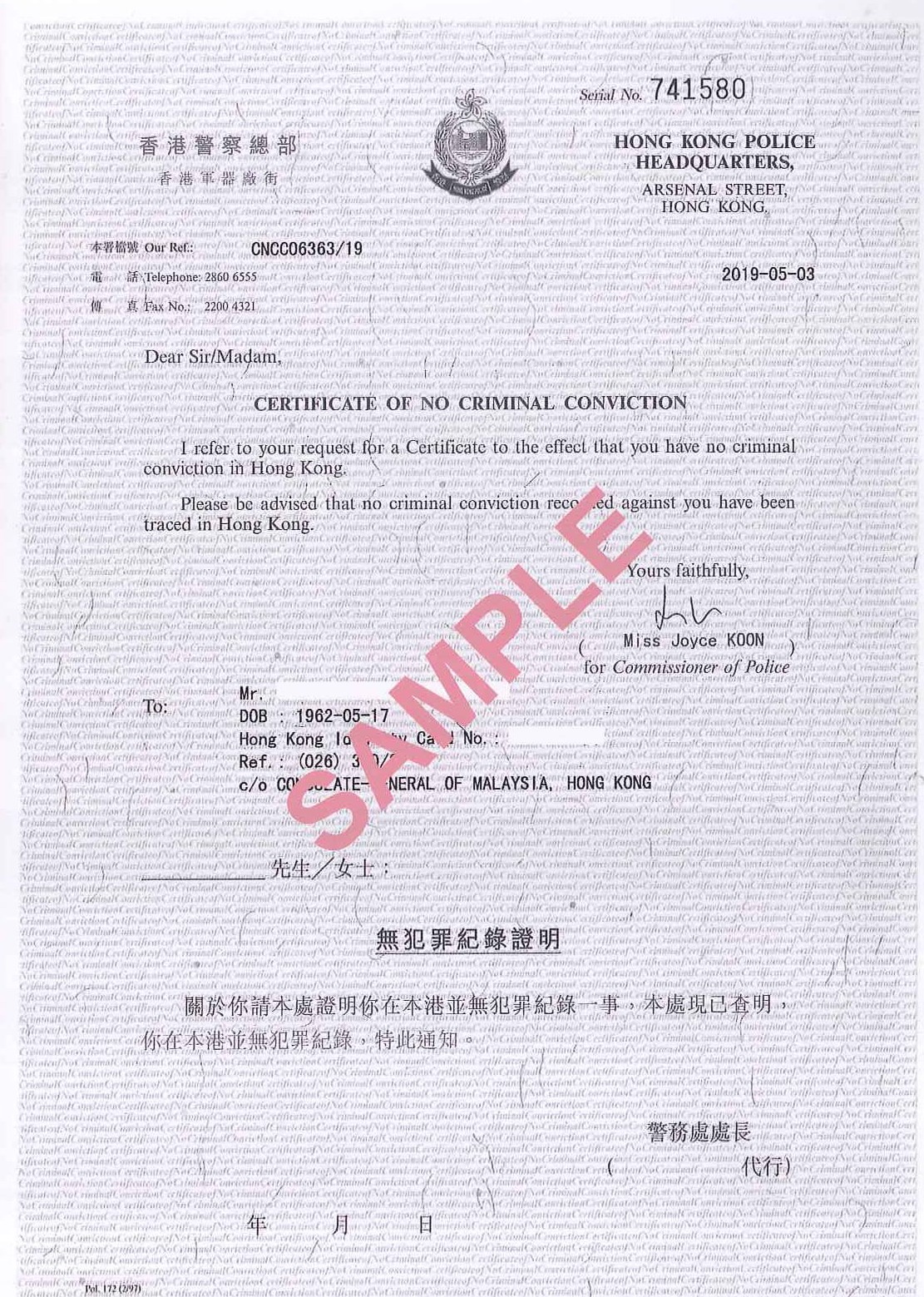

| 5. Additional Services for LGC application from Hong Kong, Singapore and China (One time). | AH | AH | AH |

| 6. Advice on to hotel reservation on Kuala Lumpur area. | AH | AH | AH |

| 7. 2nd trip to Immigration to obtain first MM2H Pass & Visa for dependent(s). (One time – within 6-month period) | AH | AH | AH |

| STAGE-THREE : Plan B & C – After MM2H Pass & Visa | A | B | C |

| 1. Assist to obtain approval to withdraw part of FD one year later. (One time) | AH | AH | √ |

| 2. Assist to obtain MM2H Pass & Visa extension on new passport. (One time) | AH | AH | √ |

| 3. Assist to transfer Pass & Visa from old to new passport. (One time) | AH | AH | √ |

| ADDITIONAL SERVICES FOR PLAN C ONLY | AH | AH | √ |

| 4. Assist to obtain Student Permit for Children under 18 (One time). | AH | AH | √ |

| 5. Assist to submit application to Immigration add one dependent pass (spouse or child). (One time) | AH | AH | √ |

| 6. Assist to renew Insurance coverage from 2nd year onwards. | AH | AH | √ |

| 7. Assist to obtain approvals to purchase a new Tax-Free Car. | XX | XX | XX |

| 8. Advice on appointing agent to import personal car. | AH | N/A | √ |

| 9. Advice on how to convert driving license. | AH | N/A | √ |

| 10. Advice on employment & part-time work permit. | AH | AH | √ |

| 11. Assist to apply for I-Card (when the system resumes) (One time). | XX | XX | XX |

| 12. Apply to terminate MM2H Status and to obtain approval to withdraw FD. (Within 5 years from issuance date of MM2H Pass & Visa). | AH | AH | √ |

| AH = Charges Based Ad Hoc Basis |

General TERMS & CONDITIONS of Our A-B-C PLANS

- OTHER FEES TO BE BORNE BY APPLICANTS:

- Visa fees payable to the Immigration of Malaysia directly for each individual:

-

-

- Social Visit Fee @ RM 90 per year.

- Multiple Entry visa @ RM 0 to RM 100 per year (if applicable).

- Journey Performed Fee (RM 500 – RM 550) per person (if applicable).

-

- Medical Check-Up Fee payable with cash to the doctor (if applicable).

- Medical Health Insurance Premium payable directly to the insurance company.

- Accommodation and transportation expenses during applicants’ visit to Kuala Lumpur.

- All fees due to respective parties mentioned above are to be paid by applicants.

2. APPEAL CONDITION:

- In the unlikely event when applications are being declined by the Ministry, we would file for appeals until the issuance of MM2H Conditional Approval Letter. Applicants must agree to comply to submit further supporting documents as per Ministry’s requirement.

3. REFUND POLICY:

- All refunds shall be made in RM which we received. There shall be no compensation due to the fluctuation of the foreign exchange rate. All bank service charges shall be borne by the applicant.

- No refund shall be made under circumstances due to your negligence of the conditions or any other personal matters arising including failure in meeting the K.I.V. conditions set forth by the authorities or health screen at the medical check-up stage.

- No refund shall be made if applicants have neglected the 6-month condition as per MM2H Conditional Approval Letter.

- No refund shall be made if declared information & submitted documents are not genuine.

- No refund shall be made if applicants are black listed by the Immigration Department.

- No refund shall be made if applicants do not comply with terms & conditions set forth by the authorities.

- No refund shall be made if the Ministry delays in processing the applications.

- No refund shall be made if the Ministry is not able to complete the financial verification.

- The Agent Appointment Fee is not refundable if you abort the application.

4. PRIVACY STATEMENT:

- All documents and information submitted to Summerfield MM2H shall be kept strictly confidential and used for MM2H application purpose only.

- Under no circumstances, will any documents, already submitted to the relevant authorities, be returned. (for security reasons)

Our Bank Account Details

Please send the amount of payment equivalent to Ringgit Malaysia (RM) to our Bank Account as below:

CIMB Client Account

| Account Name | : | Summerfield Property (M) Sdn Bhd |

| Account Number | : | 8600 870 605 |